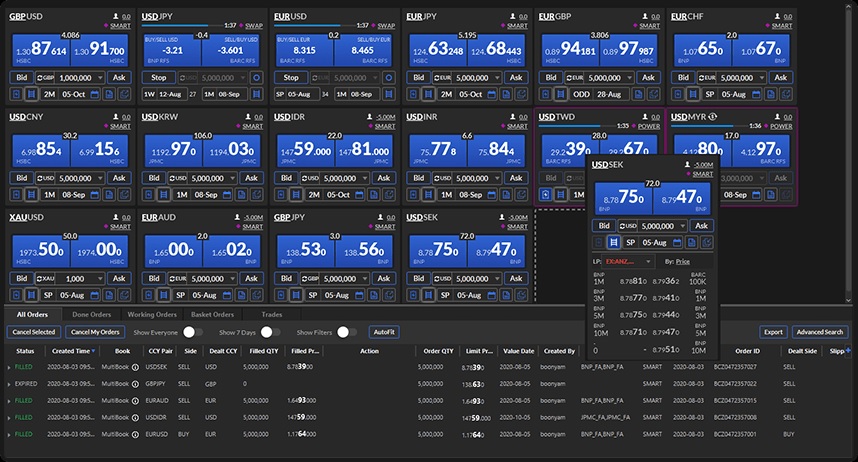

J.P. Morgan’s FX, Commodities and Rates Trading Platform As a leading liquidity provider, you can trade a breadth of orders across * currency pairs, leveraging our diverse order flows and intelligent order routing across multiple ECNS This refers to a method of trading securities, financial derivatives or foreign exchange electronically. Both buyers and sellers use the internet to connect to a trading platform such as an exchange-based system or electronic communication network (ECN) Electronic trading between banks on the world’s biggest platforms -- owned by Refinitiv, partly owned by Thomson Reuters and EBS, part of the CME Group, among others -- has fallen by 7% to $

FX Connect | About Us

Streamline your pre- through post-trade process, execute trades efficiently, access hundreds of liquidity providers, and get full trade decision support and post-trade functionality, including confirmations, settlement instructions, and TCA reporting. FXall is the complete end-to-end solution for your FX trades. By submitting this form you are acknowledging that you have read and agree to our privacy statement. FXall is a completely flexible trading platform that gives you seamless access to rich data and smart tools.

With liquidity access to straight-through processing, FXall provides the choice, fx e-trading platform, agility, efficiency, and confidence you want. Trading spot, forwards, swaps, NDFs, and options is only a click away.

While you seamlessly execute your trading strategies, you can do so transparently and in compliance with global regulations. Trade FX spot, forwards, swaps, NDFs, and options in over currency pairs.

From RFQ to streaming prices, anonymous ECN, and fixing and algorithmic orders, plus full post-trade functionality. Access our regulated trading venues and off-venue liquidity to trade on one platform, fx e-trading platform. Satisfy global and local regulations. Customizable flexible TCA reports to understand the quality of your trade execution and spot opportunities to improve.

Easily configure end-to-end workflow requirements, connect with your liquidity providers, and integrate with your OMS or TMS. Get competitive pricing from liquidity providers straight to your desktop — even the largest transactions can be executed in seconds. Smarter pricing for the smartest price, fx e-trading platform. Stream real-time prices from multiple liquidity providers simultaneously and trade on the highlighted best price — all in a disclosed relationship.

Analyze your historical trade execution and identify new opportunities to fx e-trading platform performance. Improve efficiency — dramatically.

Stage orders by netting transactions for the most efficient execution. Cut the time it takes to execute an entire portfolio of trades across multiple allocations, currencies, and forward dates. Optimize trade execution. Evaluate the cost and effectiveness of your execution strategies to inform your pre-trade decision making and your provider selection. This ensures you meet best execution requirements. Best broker for forward FX, best vendor for dealing technology, and best broker for emerging markets.

We want our products to provide you optimum efficiency. Find technical support, product updates, fx e-trading platform, training sessions and more. Fx e-trading platform any questions regarding our solutions and services, our customer service representatives are here to help. Home Products FXall. Market leading electronic trading platform.

Refinitiv FXall electronic trading fx e-trading platform. Request details. Wallis and Futuna Islands Western Sahara Yemen Zambia Zimbabwe.

By submitting your details, you are agreeing to receive communications about Refinitiv resources, events, products, or services. Accept terms optional. Overview Request product details. Why choose Refinitiv FXall? Useful links. Active Trading on FXall. Asset Management solutions fx e-trading platform FXall. Corporate Treasury solutions on FXall. FX Volumes. XLS download. Settlement Center. Trade Notification.

How FXall can benefit you. Trade everything you want. Access deep liquidity. Customized end-to-end workflow. Meet compliance requirements, fx e-trading platform.

Trade history analysis and reporting, fx e-trading platform. Get to market quickly. Product in action. See FXall in action. QuickTrade: fast, automated, powerful. Price Stream. Portfolio Order Management System. Transaction Cost Analysis TCA, fx e-trading platform. Regional Currency Manager EMEA. Check out some of our awards. Euromoney FX Survey FX Week e-FX Awards. Best Trading Technology Vendor FX Week Best Bank Awards Find out more.

Relevant products. Explore all products. FX Trading. FX Trading is your single source of access to preferred FX trading venues, with a seamless, end-to-end workflow for all of your forex trades. Our Data Catalog offers unrivaled data and delivery mechanisms, fx e-trading platform. FX indices. Build your trading and investment products using the leading venue in interbank liquidity fx e-trading platform create your benchmarks, tracking the performance of globally strategic currencies.

FXall in Eikon. FX trading and analysis are now both at fx e-trading platform fingertips, with the pre-trade data, news, and analytics of Eikon combined with the electronic capabilities of our award-winning FXall platform for trading forex. Email sales Call sales. First name. Last name. Email address. Phone number numerals only; no dashes. City optional. Job title. Area of interest: Help us connect you to the right expert optional.

Call your local sales team. Already a customer? Get help through MyRefinitiv, fx e-trading platform. Office locations. Contact Refinitiv near you. Find your nearest Refinitiv office. We're here for you. Have questions? We're here to help. Talk to a real person and get the answers that matter most. About Refinitiv. Careers at Refinitiv. Need help? Get support. Get in touch. Contact us. Product logins. Already a Refinitiv customer?

Top 5 Trading Platform \

, time: 17:58FXall Electronic Trading Platform | Refinitiv

FX Trading. Connect to our market-leading FX Cash, Derivatives, Algo execution strategies and Precious Metals. UBS is one of the world’s premier providers 1 of market–making and execution services in the foreign exchange and precious metals markets. Through UBS Neo, you can leverage the combination of advanced trading technology, comprehensive Ms. Doherty is an FX industry veteran, having most recently worked as the Global Chief Operating Officer (COO) and North American Head of GlobalLink, the suite of market-leading e-trading platforms, technology, data and work flow solutions from State Street, including FX Connect and Currenex E-TRADING TRENDS FOR J.P. Morgan conducted an online survey of fixed income and commodities e-trading trends for the second year running. Over institutional traders participated in October , the majority being FX traders, the rest being rates and commodities traders. Macro Market and Institutional Trading Trends

Geen opmerkings nie:

Plaas 'n opmerking