You set a buy stop when you assume that the price will rise and want to buy at the price higher than the now available, while you use a buy limit when you want to buy at the price lower than the now available, assuming the price will fall and then bounce back. Stop-limit orders help traders to trade efficiently in the Forex market 14/12/ · Before we go into the comparison of Limit Order and Stop Order, let’s figure out what they are separately. Limit Order. Limit Order is an instruction to execute a trade at the requested price or better. The SELL limit order is set below the current price, and the BUY limit order is Estimated Reading Time: 2 mins Sell limit and sell stop in forex - LiteForex

Limit Order vs. Stop Order: What's the Difference?

Sell limit sell stop are some of the tools a forex trader can use to make headways in the forex market. Forex traders are not directly involved in the forex market.

They do have their own accounts; they initiate actions regarding what they want to trade and how they want to trade it but not without a forex broker, forex difference between stop and limit. One forex trading tool a forex trader uses to communicate with her broker is the forex order s. There are quite a number of them but for the purpose of this article, we are going to focus on the following.

A limit order is an order to buy or sell a particular security at a specified price or at a price better than the specified price. Limit orders are of two types.

A buy limit order is an order given by a trader to her broker asking her to buy a particular security if the price of the security falls to the stated limit price or even further than that. The trader buys these securities in hopes forex difference between stop and limit their value would rise in future. If the value of the securities eventually rises, the trader sells them off to make profit.

The trader can as well set a sell limit forex order to take care of this. A sell limit forex order is an order given by a forex trader to her client to sell a particular security if the value of the security rises to a particular point or further.

On a normal ground, traders sell their security when the price of the security rises above what the security cost. By doing so, they are able to make some profit from it. If the value of the security is expected to go down in future, the trader can sell the security at its current price and then buy them back when it is cheaper.

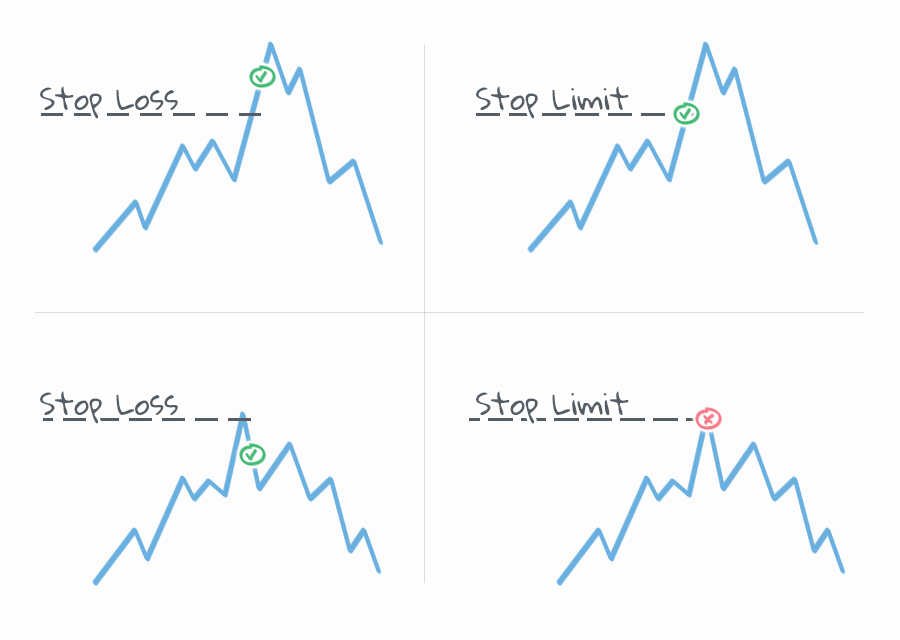

In forex trading, a sell stop forex difference between stop and limit a trade order from a trader to a broker asking that a trade be executed in the best possible price once the price gets to a stated price or below. A stop-limit order is a combination of the features of a limit order with that of a stop order. In a stop-limit order, two different prices are picked. A forex difference between stop and limit limit order is an order with the help of which you can open a buy position below the market price.

When setting a buy limit order you assume that the price will first go down to its level and then go up from it. The buy limit order is not guaranteed to execute. Buy limit Forex order on MetaTrader 4 ensures that the future "Ask" price is equal to the value you set yourself. It is used when you expect the price to first go down and then rise up again.

This order allows you to buy an asset at or below the price you specify, forex difference between stop and limit, although it is not guaranteed to execute. A buy stop order is triggered after reaching a particular price level and a position is opened at the next available market price, while a buy limit order means a trader will open a buy position at an exact pre-determined price or below it once it is reached. You set a buy stop when you assume that the price will rise and want to buy at the price higher than the now available, while you use a buy limit when you want to buy at the price lower than the now available, assuming the price will fall and then bounce back.

Stop-limit orders help traders to trade efficiently in the Forex market. A buy stop order is placed in order to buy above the market.

The asset is bought at the next available market price after forex difference between stop and limit buy price this way. A buy stop order is often used to cover a failing short position. A sell stop is an order placed below the market in order to sell an asset. Once the stop price is reached, a market order to sell is activated. A buy stop works the other way round.

It is placed above the market price in order to buy an asset at a higher price. Once the buy price is reached, a market order to buy is activated. Both orders allow for some slippage as the market price and the stop price normally have a marginal discrepancy. A sell limit order is placed in order to sell an asset at a specified price or better. Sell limit Forex can only be executed at a sell price or higher. A trader expects the price to go up for some time and then change its direction - he puts a sell limit at an estimated price reversal in order to maximize the profits The execution of a sell limit order is not guaranteed.

DREAM DRAW. LiteForex raffles a dream house, forex difference between stop and limit, a brand new SUV car, and 18 super gadgets. LiteForex Dream Draw! Home Beginners Beginners Beginners Glossary Sell limit and sell stop in forex. There are quite a number of them but for the purpose of this article, we are going to focus on the following Limit order Stop order Stop-limit order WHAT IS A LIMIT ORDER? Limit orders are of two types The buy limit forex order Sell limit forex order BUY LIMIT FOREX ORDER A buy limit order is an order given by a trader to her broker asking her to buy a particular security if the price of the security falls to the stated limit price or even further forex difference between stop and limit that.

SELL LIMIT FOREX ORDER A sell limit forex order is an order given by a forex trader to her client to sell a particular security if the value of the security rises to a particular point or further. SELL STOP AND STOP-LIMIT FOREX ORDER In forex trading, forex difference between stop and limit, a sell stop is a trade order from a trader to a broker asking that a trade be executed in the best possible price once the price gets to a stated price or below.

FAQs What is a buy limit forex? What is a buy limit on mt4? What is the difference between buy stop and buy limit in forex? What is a buy stop in forex? What is sell stop and buy stop in forex? What's a sell limit? Start Trading. Forex buying and selling is very important in the forex career life of every forex trader In online trading business, a position depicts the state of a trader when he enters th Follow us in social networks!

Facebook Twitter Instagram LinkedIn Youtube Telegram RSS Feed MQL5.

how to types forex market order-buy limit-sell limit-buy stop- sell stop- stop loss-easy to learn

, time: 4:59How does a stop order and a stop limit order differ?

Thus, for buying the lows and selling the highs, I’d prefer to use LIMIT orders. Limit orders may also help you avoid stop-outs during high volatility based gaps. Meanwhile, in times of usual volatility, and price action confirmation trading, stop orders may be more beneficial than the limit orders. Which Forex Order type do you prefer? 11/8/ · It's actually really simple. A buy limit order would be an order to buy the market at a price below the current price. A buy stop order would be an order to buy the market at a price above the current price. It's just the inverse with sell orders. A sell limit order would be an order to sell the market at a price above the current price You set a buy stop when you assume that the price will rise and want to buy at the price higher than the now available, while you use a buy limit when you want to buy at the price lower than the now available, assuming the price will fall and then bounce back. Stop-limit orders help traders to trade efficiently in the Forex market

Geen opmerkings nie:

Plaas 'n opmerking